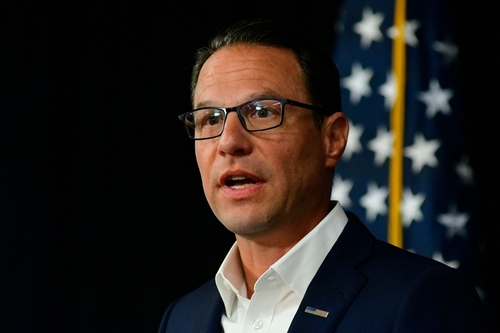

The Pennsylvania Manufacturers’ Association (PMA) is not happy about Gov. Josh Shapiro’s plan to speed up an ongoing reduction of Pennsylvania’s corporate net income tax (CNIT), which corporations pay on the profits they make in Pennsylvania.

As part of his newly announced 2025-2026 budget proposal, Shapiro wants to include the combined reporting policy, which would require every Pennsylvania business that also operates in other states to report income for all entities within a unitary business as a single entity for CNIT purposes.

Basically, that means all Pennsylvania corporations would have to combine their profits from all of their subsidiaries, including those operating out of state, to determine their taxable income.

First introduced two decades ago, the combined reporting plan would give the Pennsylvania Department of Revenue the power to impose Pennsylvania tax liability on business operations in other states. But according to PMA President and CEO David Taylor, the Secretary of Revenue already has the power to disallow business deductions deemed to be improper by that department.

“Wiser leaders have rejected what is actually a complicated, burdensome, unpredictable, and uncompetitive process with no windfall for government,” said Taylor in a Feb. 19 PMA Bulletin.

The PMA says implementing the combined reporting plan would increase tax complexity, eliminate taxpayer certainty, increase taxpayer compliance costs, and discourage out-of-state businesses from investing in Pennsylvania.

While Shapiro argues that the policy closes tax “loopholes,” PMA says the “disastrous policy” would have significant negative economic consequences for Pennsylvania.

For instance, if combined reporting was adopted, the change would add to the cost of doing business in Pennsylvania, and give out-of-state businesses another reason to avoid the commonwealth, said PMA, forcing Pennsylvania-headquartered companies with mostly out-of-state operations to be the first “to head for the exit.”

“If Gov. Shapiro was serious about helping the economy grow, he would deliver on his 2022 campaign promise to reduce CNIT to 4 percent by 2025,” Taylor said.

In addition to combined reporting, Shapiro also proposed eliminating the Bank Shares Tax, Mutual Thrift Institution Tax, and the Private Bank Tax, with the inclusion of financial institutions paying those taxes to the CNIT, according to the PMA Bulletin.

Combined, the governor projects these tax changes to increase state tax collections by $3.7 billion over the next five years, but PMA says the revenue doesn’t exist because of steps Pennsylvania lawmakers made nearly a decade ago to protect against tax avoidance.

“Pennsylvania’s chronic economic underperformance over many decades represents a massive opportunity cost for our commonwealth and our citizens,” Taylor said. “As state government faces a structural deficit driven by our demographic crisis, Pennsylvania needs an aggressive pro-growth agenda to expand our economy and with it our tax base.

“Hiking the spending baseline, burning through our reserves, draining the Rainy Day Fund, and inflicting further abuse on business taxpayers will not help that effort,” he added.

Pennsylvania already has strong measures in place through established and expanded add-back provisions that address profit shifting, said PMA.