The Pennsylvania Housing Finance Agency announced Monday it is accepting bids for the purchase of $4.5 million in mixed-use development tax credits.

The tax credits will benefit the state in two ways, PHFA said – first, by providing the winning bidders with the opportunity to reduce their state tax liability, and second, by using the funds generated by the sale of the tax credits on the construction or rehabilitation of mixed-use developments throughout the state.

Bidders can be companies, organizations, or individuals, and bids must be submitted by 2 p.m. on July 15. The bidding process aims to raise as much money as possible from the tax credits to make significant investments in community revitalization projects. Projects receiving the tax credit funds will be selected through a competitive process later this year.

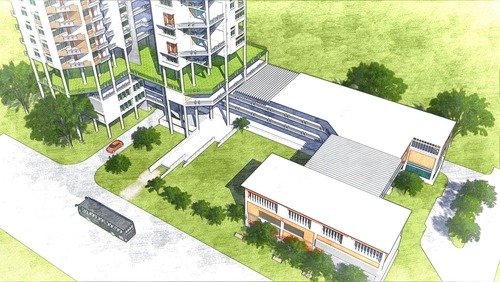

“We have had solid support for this program from the private sector during its first five years,” said PHFA Executive Director and CEO Robin Wiessmann. “The value of mixed-use developments is that they not only provide much-needed affordable housing, but their commercial component adds an economic development spark in those communities.”

The tax credit program was created as part of the fiscal year 2016-2017 budget. The PHFA is responsible for administering the credit. PHFA is authorized to sell the credits and is expected to announce the awards within 90 days after the bidding closes. Credit awards will be made in 2022 but are not effective until 2023 against the winning bidders’ 2022 tax liability.