During a House Majority Policy Committee hearing this week, several Pennsylvania business leaders testified on the negative impacts of Gov. Tom Wolf’s budget proposal on businesses and employers already struggling from pandemic-related issues.

Wolf on Feb. 3 released his proposed 2021-22 budget, which includes a 46 percent increase in the Personal Income Tax – a tax paid by an estimated 855,000 small businesses across the state – and a proposed hike in minimum wage and higher energy taxes.

“The budget proposed by the governor is really out of touch with the reality facing business owners in all sectors across the state,” said Committee Chair Martin Causer (R-Cameron/McKean/Potter). “Increasing taxes and artificially inflating wages – on top of the revenue losses caused by COVID-19 mitigation efforts – would significantly increase the cost of doing business in the Commonwealth and the end result would be the loss of thousands of jobs.”

Joseph A. Aldcowski, chief financial officer for Diaz Manufacturing Company LLC and the Diaz Group of Companies based in Montrose, said higher taxes not only make his business less competitive, but increase costs to customers.

“Many of these customers have the option to source comparable products from other suppliers in states with more business-friendly tax structures,” Aldcowski said. “We are presently operating at a disadvantage with competing foreign products, primarily from China, and Gov. Wolf’s proposal would only serve to worsen our position.”

For the energy industry, Carl Marrara, vice president of government affairs at the Pennsylvania Manufacturers’ Association, argued that Wolf’s proposed severance tax on natural gas production is detrimental to the successful operations of Pennsylvania manufacturers and threatens America’s role as a global energy leader.

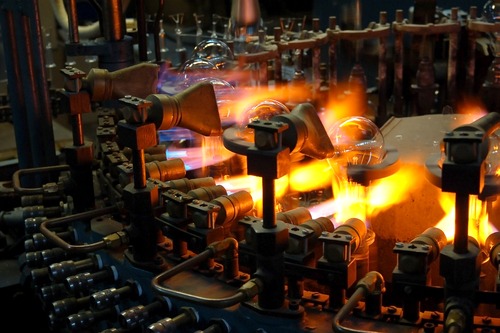

“For many manufacturers, energy costs are one of the number one imports in creating that finished good,” he said in his testimony. “Think about all the different kinds of manufacturing, think about glass manufacturers. There are several glass manufacturers in Pennsylvania. They’re firing ovens at thousands of degrees, seven days a week, 365 days a year. The natural gas bill for the typical glass manufacturer can be over a million dollars a month. And then add another 10 percent to that. It makes it very, very uncompetitive to site locations in Pennsylvania.”

Marrara continued, stating that natural gas and natural gas liquids are the building blocks of modern manufacturing and that Pennsylvania leaders should be embracing that as a state asset, not restricting it.

“[Manufacturers] cluster around whatever feedstock they use the most. And the closer that you can source that feedstock, the lower the transmission cost is, the more competitive it is to site,” he said. “So, we should start to see manufacturers cluster around those areas where those natural gas liquids can have their foundational footprint here in Pennsylvania. And that is going to be just an absolutely dynamic economy that Pennsylvania has the ability to create here, but we need to do it the right way and certainly new additional taxes on the energy industry and new crushing regulations are not the way to do that.”

Guy Berkebile, president of Guy Chemical Company Inc. in Somerset, offered testimony that pointed to the 2017 federal Tax Cuts and Jobs Act to show the value of tax cuts instead of tax increases in growing the economy. He explained that he took the savings achieved under that law to invest in new equipment, build a larger lab, provide a higher salary and bonuses to employees, and create additional jobs.

“All the good that came to the American economy and the growth and expansion of industry that we have seen because of the lowering of tax rates at the federal level is challenged by Gov. Wolf’s proposal,” he said.