Pittsburgh-based natural gas company CNX Resources Corp. said Dec. 5 it agreed to acquire the natural gas upstream and associated midstream business of Apex Energy II LLC in the Appalachian Basin for roughly $505 million.

“This transaction represents a rare opportunity to acquire a highly complementary asset adjacent to our existing operations,” said CNX President and CEO Nick DeIuliis on Thursday. “It underscores our confidence in the stacked pay development opportunities that have been unlocked from pioneering the deep Utica in this region.”

The deal with Apex Energy II, a portfolio company of funds managed by Carnelian Energy Capital Management L.P., is subject to certain adjustments, including an effective date of Oct. 1, according to CNX.

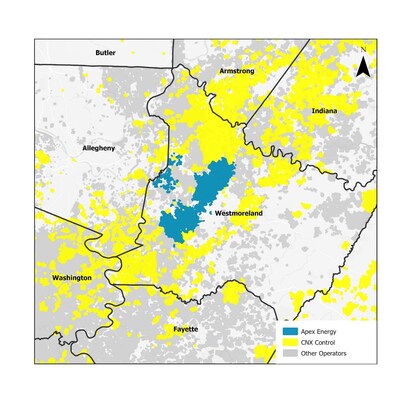

DeIuliis said the acquisition strategically expands CNX’s existing stacked Marcellus and Utica undeveloped leasehold in the CPA region and provides an existing infrastructure footprint that can be leveraged for future development.

Additionally, CNX expects operational and other development synergies to add incremental value to the core business in the coming years.

The acquisition is expected to be immediately accretive to CNX’s key metric of free cash flow per share, with the acquisition price and free cash flow profile of the assets allowing the company to maintain a strong balance sheet and preserve significant capital allocation flexibility moving forward, said CNX.

In highlighting parts of the transaction, CNX said the expected 2025 EBITDA is approximately $150 million to $160 million at recent strip, and that the fully integrated gathering midstream aligns with CNX’s low-cost strategy, with significant existing infrastructure that will be leveraged for future stacked pay development of the Marcellus and Utica shale.

The deal also will expand CNX’s core strategic development footprint by adding about 36,000 total net acres in Westmoreland County, Pa., and includes some 8,600 acres of undeveloped Utica and 12,600 acres of undeveloped Marcellus, the company said.

Completion of the transaction, which is subject to customary closing conditions, is expected to occur in the first quarter of 2025, said CNX.