Pennsylvania State Rep. Marguerite Quinn (R-Bucks) sent a letter Tuesday to New Jersey Gov. Phil Murphy to sign into law a bill that would protect the income tax reciprocity agreement between Pennsylvania and New Jersey.

“Enacting this new law would send a strong signal to each state’s taxpayers that they will not be used as political pawns in future budget negotiations, and would strengthen the strong relationship and long history of cooperative action on issues of shared interests that our states enjoy,” Quinn said in the letter.

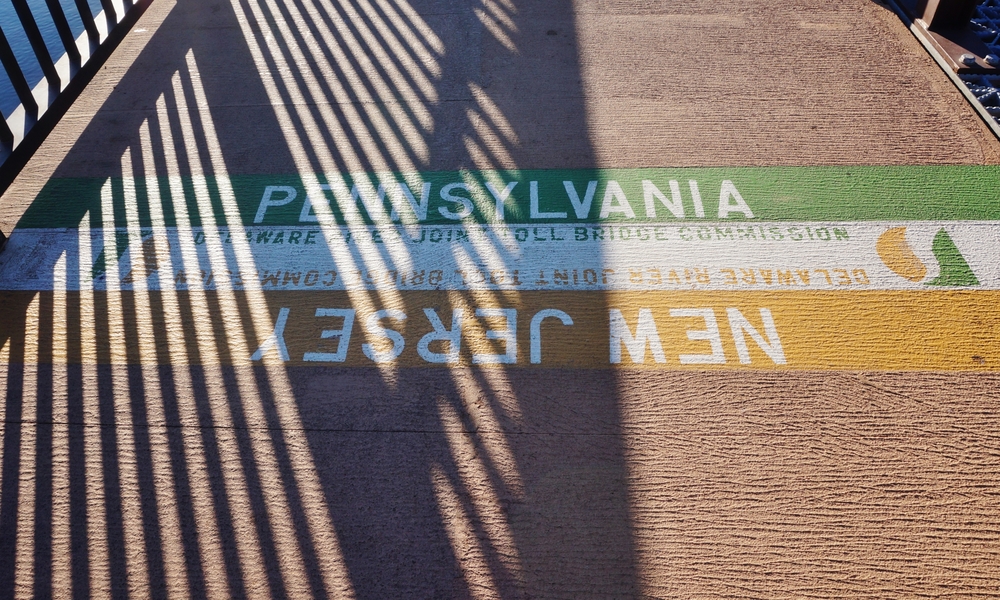

Under the income tax reciprocity agreement, compensation paid to Pennsylvania residents employed in New Jersey is not subject to New Jersey income tax, and compensation paid to New Jersey residents working in Pennsylvania is not subject to Pennsylvania income tax.

In 2016, then-Gov. Chris Christie announced his intention to repeal the reciprocity agreement but later reversed his position.

Approximately 46,000 Bucks County residents who work in New Jersey would be negatively impacted the repeal of the reciprocity agreement, Quinn said.

“As New Jersey is in the throes of a heated budget discussion, it is natural that they may look across the river toward Pennsylvania residents as a source of increased revenue,” Quinn said. “But doing so would result in legislative changes here that would hurt New Jersey’s residents and businesses. I give the New Jersey Legislature great credit for recognizing that this is an issue that should be out-of-bounds in budget discussions and working to make that clear. Hopefully, Gov. Murphy will agree and sign this into law.”