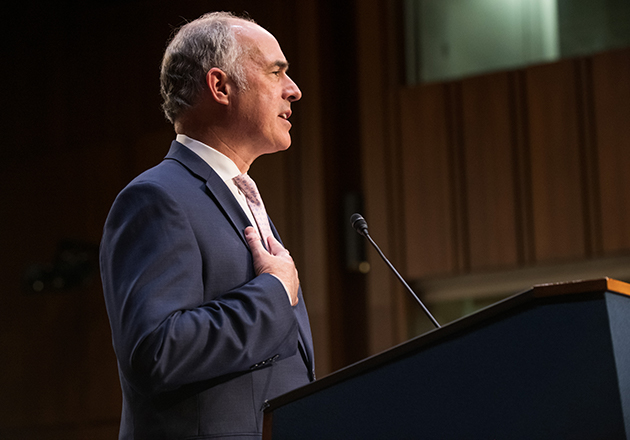

Sen. Bob Casey (D-PA) outlined Wednesday how Pennsylvania may benefit from last week’s passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion federal stimulus package to address the economic emergency caused by the COVID-19 pandemic.

“[This] response legislation will make substantial investments in our Commonwealth as we confront this pandemic, but we must do more,” Casey said. “I will continue to fight to ensure that our families and our communities have the resources they need during this time.”

The numbers provided in the outline are based on formulas and projections based on Casey’s staff’s best estimates.

For Pennsylvania small businesses, Casey said the federal stimulus will provide up to $10 million per business with fewer than 500 employees under the new Paycheck Protection Program. Up to $10,000 in Small Business Administration Emergency Grants will also be made available through the Economic Injury Disaster Loan program.

For employers, including non-profits, whose operations have been partially or fully suspended, the CARES Act will provide the Worker Retention Tax Credit, a refundable payroll tax credit for a percentage of wages and compensation paid to eligible employees during the COVID-19 crisis.

Small- and medium-sized manufacturers in Pennsylvania will be eligible for $2.3 million in funding through the Manufacturing Extension Program, which will provide them with resources to grow, reduce costs, develop their workforce, find new markets, and more.

In his outline, Casey also noted the temporary suspension of alcohol taxes for the emergency production of hand sanitizers. This exempts distilleries from the current 18 percent excise tax for distilled spirits that are being used for hand sanitizer production under U.S. Food and Drug Administration guidelines.

Specifically, for worker assistance, direct payment will be available for millions of Pennsylvania residents who are eligible for the $1,200 personal stimulus checks. Unemployment compensation benefits will be increased by $600 per week through July 31 and will be extended by an additional 13 weeks. The CARES Act will also allow the early distribution of retirement savings by waiving the 10 percent tax on early withdrawals up to $100,000 from IRAs and defined contribution plans.

Other funding assistance allotted through the CARES Act include $18.782 million in funding for Pennsylvania’s health system from the Centers for Disease Control and Prevention Public Health Emergency Preparedness fund, and $4.964 billion split 55/45 between state and local governments.