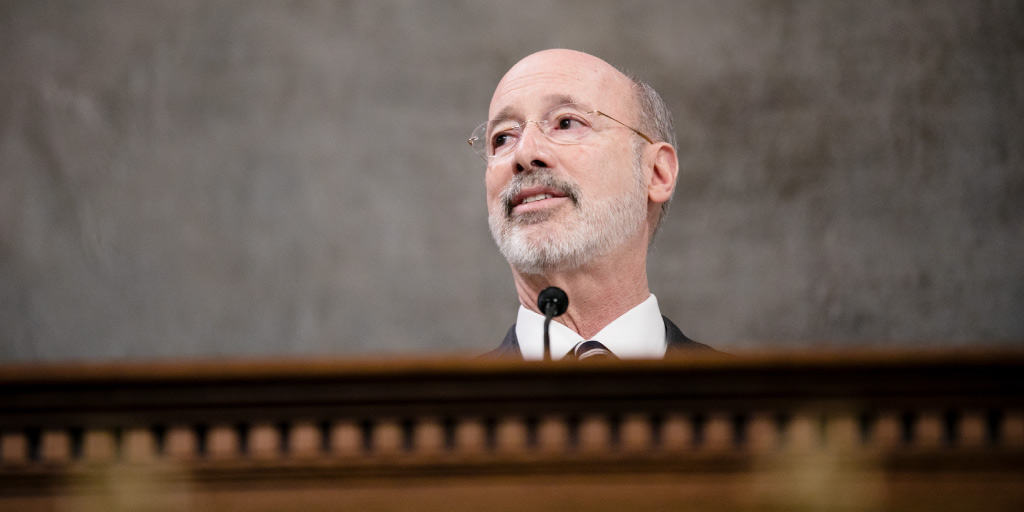

Gov. Tom Wolf’s latest proposal to change the way natural gas production is taxed in Pennsylvania was met with a familiar chilly reception from the industry and from some members of the General Assembly, who urged Wolf to focus on the COVID-19 pandemic instead.

Wolf’s proposed severance tax on natural gas was short on details, but his goal was to provide a funding source for workforce development and other programs that will get Pennsylvanians into high-demand careers once the economy is back on track. Wolf will lay out more details on his plans for the budget on Feb. 2, but bipartisan critics fired back this week at what they saw as another plan to burden an important sector of the economy and urged Wolf to instead focus his energies on reigning in COVID-19 once and for all.

“The governor and his administration should have no other top priority than getting Pennsylvanians vaccinated,” said House Majority Leader Kerry Benninghoff (R-Centre/Mifflin). “This announcement was as disappointing as it was unsurprising. Gov. Wolf outlined the continuation of his tax and spend pattern of picking winners and losers and targeting Pennsylvania growth industries.”

Pennsylvania currently does not levy a severance tax on oil and gas production. It instead charges a flat fee on producing wells, which analysts have said generates a fraction of the revenues to the state that a tax would produce. Wolf has floated a severance tax in previous years, touting them as a revenue stream that would fund a variety of useful programs.

State Democrats said Pennsylvania could certainly use some relief from the stubborn coronavirus, but also insisted that singling out the energy industry was a “non-starter.”

“Targeting a single industry with another layer of taxes – our oil and gas industry, which employs tens of thousands of Pennsylvanians – is a nonstarter,” State Rep. Pam Snyder, (D-Greene/Fayette/Washington) said in a statement that included three other Southwest House Democratic members.

The statement tied energy into the effort against COVID-19 due to its role in plastics manufacturing and the ultimate production of personal protective equipment (PPE) used by healthcare workers. “This industry was deemed an essential industry by Governor Wolf last year,” the statement said, adding, “This is not just a tax on the oil and gas industry; it would be a tax on our pandemic recovery.”

Wolf has already riled the energy industry with his plan to join the Regional Greenhouse Gas Initiative, a multi-state collaboration to reduce carbon dioxide emissions from power plants and other industrial sources. Slapping a new tax on the industry would actually have a negative impact on the entire economy, critics contended.

David Taylor, president and CEO of the Pennsylvania Manufacturers’ Association said in a statement: “Gov. Wolf’s proposal for a new, additional tax on Pennsylvania energy production threatens our commonwealth’s business competitiveness and America’s role as a global energy leader. The best way for state government to get more revenue out of the natural gas industry is to help it grow.”

The Pennsylvania Chamber of Business and Industry (PA Chamber) said the governor’s proposals, including the additional tax on the energy industry and a government mandated wage increase, would slow the Commonwealth’s economic recovery by increasing employer tax burdens and the cost of doing business in Pennsylvania.

In addition, the governor again called for reducing the Corporate Net Income Tax from 9.99 percent to 9.49 percent on Jan. 1, 2022, then continuing to reduce the tax incrementally to 6.49 percent by 2026. Wolf is also proposing to close the Delaware Loophole and shift to combined reporting to tax corporations as a single entity.

In response to that proposal, PA Chamber President and CEO Gene Barr said, “Linking a much needed reduction in the state’s Corporate Net Income Tax – which is one of the nation’s highest – to the implementation of mandatory unitary combined reporting is not the way to move Pennsylvania forward. This complex, overly broad tax reporting system will lead to increased costs putting Pennsylvania job creators at a greater competitive disadvantage. Rather, we encourage lawmakers to enact substantial state tax reforms that are based on the principles of competitiveness, fairness, predictability and simplicity.”